Guest Blog | Posted on May 24th, 2021 | return to news

Everything you need to know about the stamp duty holiday

Guest blog by Ella Pumford, content manager St Modwen Homes

Buying and owning a home is a key aspiration for many people. Having a place to call your own is an essential part of life but getting onto and climbing the property ladder can be expensive – the average property price in the UK is now £238,831.

But if you’re in the market to buy your first or next home, now may be the best time to do so. New government initiatives mean that there are now a variety of opportunities to save money when buying your home. One money-saving scheme includes the stamp duty holiday. Here, we explore everything you need to know about the stamp duty holiday.

What is stamp duty?

Simply put, stamp duty is a tax on property sales. You’ll likely have to pay stamp duty if you’re buying residential property in England or Northern Ireland. Stamp duty is an important tax for the government. According to HM Revenue and Customs, stamp duty raises about £12 billion every year for the government.

In Scotland, stamp duty is replaced by a Land and Buildings Transaction tax. In Wales, homebuyers may have to pay a Land Transaction tax.

The government has introduced a tax break on stamp duty, which is currently ongoing. Since July 2020, people buying homes in England and Northern Ireland have not paid tax on the first £500,000 of the property value. The rates previous to this meant that stamp duty was paid on properties above the value of £125,000. This was set to return to normal after 31 March 2021. However, the stamp duty holiday has since been extended.

When does the stamp duty holiday end?

As mentioned, this tax break was scheduled to end after 31 March 2021. However, the scheme proved popular for homebuyers, homebuilding businesses, and estate agents. The relief helped boost a property market that had been hit by Covid restrictions and national lockdowns.

Subsequently, the government has extended the stamp duty holiday until 30 June 2021. After this point, there will be a gradual return to the usual rates of stamp duty.

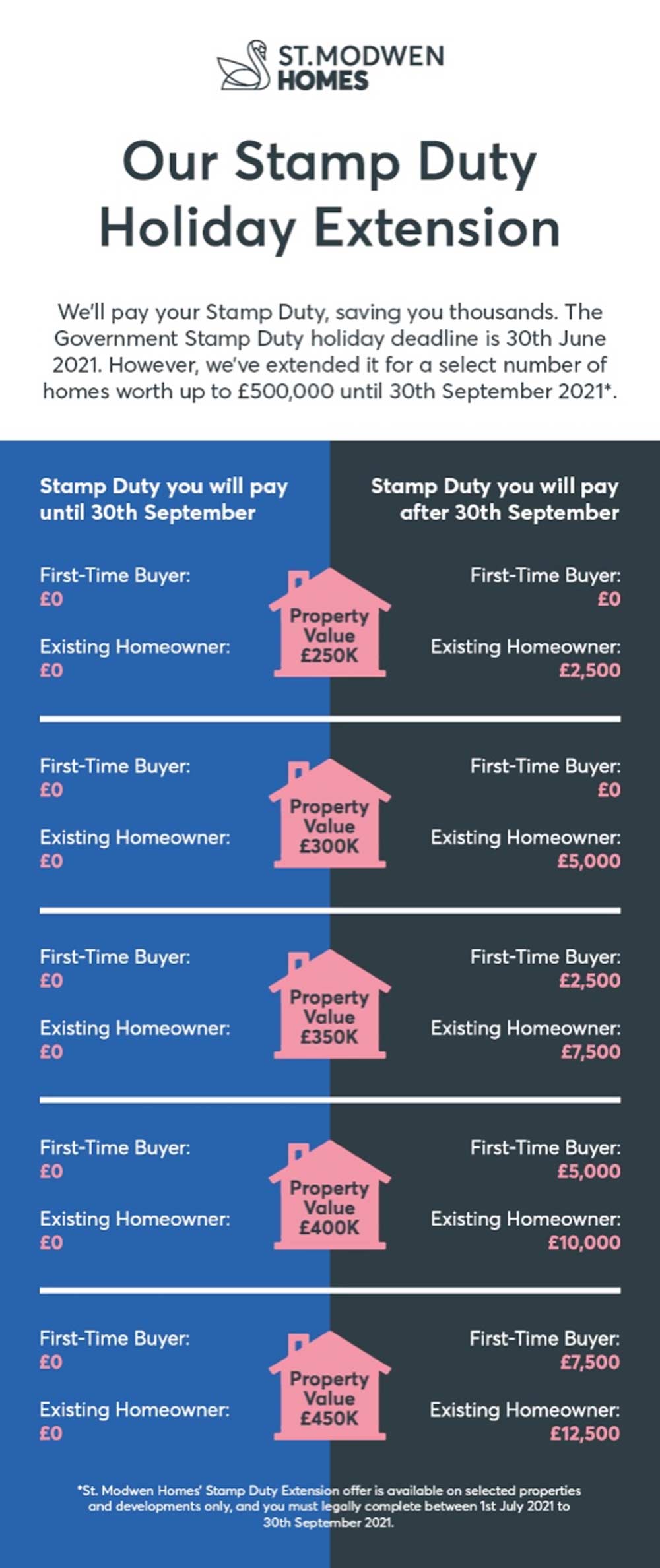

However, national housebuilder, St Modwen Homes, is offering a stamp duty holiday extension until 30 September 2021*. The homebuilders will pay the stamp duty for a select number of homes worth up to £500,000 – matching the initial holiday the government offered for three months after the treasury scheme ends. This could save homebuyers thousands.

How much could I save?

Tax can be complicated; we all know it. And stamp duty comes with so many boundaries for property value. Ultimately, the amount of tax you’ll have to pay depends on if you’re buying a house for the first time or not, and the value of the property.

You can find out exactly how much stamp duty you will owe through the Stamp Duty Land Tax (SDLT) calculator. Or you can get a solid idea from this handy guide from St Modwen Homes, which reveals what you should expect to pay with their stamp duty extension on different home values for both first-time buyers and property ladder climbers. The guide also shows how much you can expect to pay after their stamp duty holiday extension ends.

As the guide explains, both first-time buyers and existing homeowners will not have to pay any stamp duty on properties up to the value of £500,000. However, after 30 September 2021, this exclusive offer from St Modwen Homes will end and you will have to pay stamp duty. This means that if you buy a house for £350,000, first-time buyers will have to pay an extra £2,500 and existing homeowners will have to pay £7,500.

Ultimately, the stamp duty holiday extension can represent savings of up £15,000. So, if you’re looking to buy a home, completing the sale before the end of September may be in your best interest.

Buying a home is a rewarding experience. But you could be rewarded further by snapping up a property before the end of June (or the end of September for those claiming exclusive offers). If you’re looking into buying a home in the near future, you may want to accelerate your efforts to find your dream home and complete its sale. It could save you thousands.

*Full T&Cs available on St Modwen Homes’ website

Please share post:

LATEST NEWS